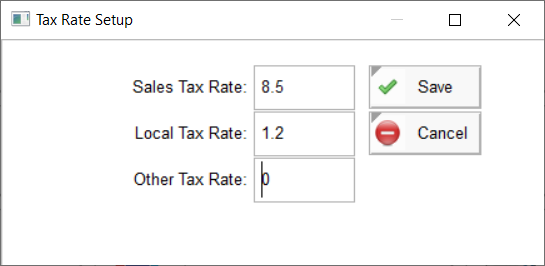

Sales Tax Setup

To setup the tax rates that are applicable to all sales in the region where your business operates, click the Settings button at the top of the Home screen, and then click the Sales Tax button. In the sales tax setup screen, you can enter up to 3 tax rates for State Tax, Local/City Tax, and other taxes if applicable. For example, in some areas in the United States, businesses have to charge their customers 2 separate taxes on each sale/service the customer purchases, state tax and city tax. In other areas, only a state tax is charged, and in some areas, there is no sales tax at all. Depending on your region, configure the tax rates that apply to that region. Tax rates are entered as percentages. For example, if your state requires you to add an additional 8% tax to each sale that you generate, then enter 8 in the State Tax field. If your city imposes a tax of 1.3% on all sales and services, enter 1.3 in the Local Tax field. In both of these cases, whenever an product or service is sold, this software will automatically apply a total of 9.3% tax on the sale, and therefore, if the sale total amount is 100.00, the amount charged to the customer is 109.30